cap and trade or carbon tax

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a cap-and-trade program issues a set number of emissions allowances each year. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system.

Cap And Trade Carbon Tax Showdown Looms Calwatchdog Com

Theory and practice Robert N.

. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing. What is Cap-And-Trade. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism.

You can tweak a tax to shift the balance. If the European Unions Emission Trading Scheme. Carbon taxes vs.

These allowances can be auctioned to the high See more. The program is central to meeting Californias. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

With a cap you get the inverse. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. A carbon tax system as the.

A cap-and-trade system is an alternative to carbon tax to reduce greenhouse emissions. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. It complements other measures to ensure that California cost-effectively meets its.

On the other hand political economy forces strongly point to less. However experts are divided on the question of which of the two main types of carbon pricing carbon tax and cap-and-trade works best. Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by-products.

A carbon tax imposes. Request PDF Costbenefit analysis of Gencos market trading with carbon-tax and cap-and-trade policies Environmental issues have made reducing carbon emissions a consensus among all. With a tax you get certainty about prices but uncertainty about emission reductions.

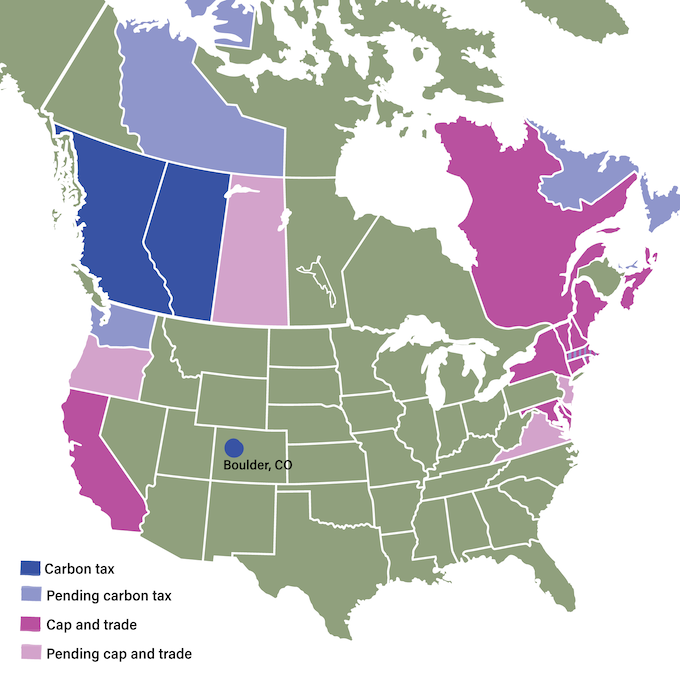

Roughly 20 countries worldwide have a carbon tax according to the World Bank but the carbon-pricing strategy has failed to win over federal lawmakers in the United States. The Cap-and-Trade Program is a key element of Californias strategy to reduce greenhouse gas emissions. Californias carbon cap-and-trade program is one of the largest multi-sectoral emissions trading systems in the world.

This system sets a maximum cap on pollution and distributes.

The Why Files 1 Carbon Tax Vs Cap And Trade

Columbia Sipa Center On Global Energy Policy What You Need To Know About A Federal Carbon Tax In The United States

More States And Provinces Adopt Carbon Pricing To Cut Emissions Aceee

Cap And Trade Vs Carbon Tax Power Sector Profits Versus Time For The Download Scientific Diagram

These Countries Have Prices On Carbon Are They Working The New York Times

Green Supply Chain News Summarizing Cap And Trade Versus Carbon Taxes To Deal With Co2

Nova Scotia S Carbon And Greenhouse Gas Legislation

Cap And Trade Definition System Example Vs Carbon Tax

How Carbon Pricing Can Further Environmental Justice Recap

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

More Trouble For Cap And Trade

Carbon Tax Versus Cap And Trade

Carbon Tax Or Cap And Trade David Suzuki Foundation

Cap And Trade Or Carbon Tax Both Sightline Institute

Carbon Tax Vs Carbon Trade Source Taschini Luca Simon Dietz Naomi Download Scientific Diagram

Econ 101 What You Need To Know About Carbon Taxes And Cap And Trade Macleans Ca

Everybody Chill Out A Little Carbon Trading Will Be Fine Grist

Carbon Tax Pros And Cons Economics Help

Difference Between Carbon Tax And Cap And Trade Difference Between